I never thought I’d own a house. I said it for years: I’ll never own a house. I repeated it over and over like it would help me accept it. The concept seemed ludicrous to me – how did anyone summon up £30k, £50k? I had zero Ks.

I was a uni drop-out, which took a huge toll on my self-worth and, although I came from a middle-class background, I was not raised to expect financial help. I couldn’t come up with a picture of how buying a house would ever be possible.

One day in 2018, I downloaded the Moneybox app. I’d heard about the LISA and it was the first place I found where I could open one. The idea that the government would give me £1,000 a year for free was like a fairy tale. I knew nothing about investing, nothing about buying a house and, really, nothing about anything.

I watched my money grow. I learned how the stock market worked. I saw my interest compound. Every penny I earned from freelancing on the side, I added to my LISA. My wonderful, frugal grandmother died and my mum gave each of us kids a few grand on her behalf. I began to believe that maybe – MAYBE – I could make the impossible happen.

Then 2020 happened. Didn’t it just really happen so hard? But it was suddenly possible for me to look at a housing market outside of rip-off Surrey because my company had gone remote, so I started working on a secret dream: moving to the Isle of Wight.

This was a move that represented freedom to me. Property was cheaper and it made the dream slightly less ridiculous.

Late 2020, my husband was made redundant. It was an absolutely awful shock; he’d worked for the same company for 15 years, so it hit hard. However, it was that little chunk of capital that tipped us over the edge into holy-sh!t-maybe-we-can-actually-do-this. Phil opened his own Moneybox LISA to maximise the government bonus and we kept chipping away at the mountain.

In 2021, we had a week’s holiday booked on the island and we viewed two properties. We offered the asking price on the second one, stood in the street outside the house.

The stock market had just started to plummet, so it was now a race against time to get through the process of withdrawing the money from our LISAs and completing on the house. There was very little time to consider, which is probably a good thing. As an overthinker, I could very easily have decided not to go ahead after the awful survey, or the rapid devaluation of our cash or or or or…

But here I am, sat in my dark, damp Victorian semi in one of the most beautiful places in the UK. We bought the house at the top of the market, so it’s barely worth more now than what we paid for it. Everything is crumbling and I can’t afford to fix it because mortgages sky-rocketed after our first term. But I did it. Here I sit.

This is a case study in what wealth means to me. I fell into investing because I was so desperate to find a path forward and I couldn’t accept that my generation didn’t get to dream of the things our parents had expected for themselves.

Wealth is a mindset (how original): I can maximise all avenues to create something for myself. This is coming from a place of immense privilege, of course, but when I think of 20-year-old me, working in Wetherspoons and thinking that might be it for her, I’m proud of teaching myself how to be financially strategic. I may not be rich, but I have scrabbled about to set little things in motion that will hopefully keep building.

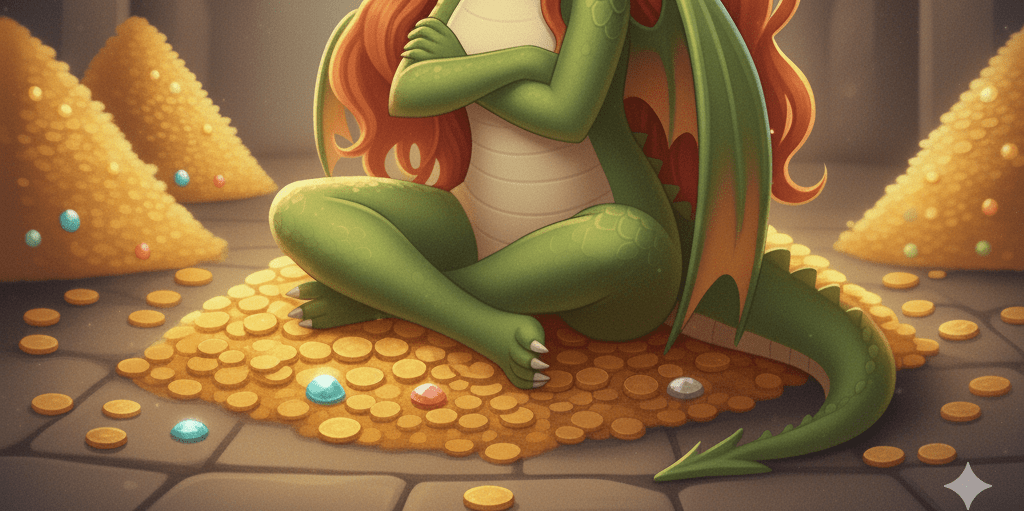

I have another way of talking about wealth: Dragon Mode. We’re protecting our finances, we’re gathering in our coins. My version of manifesting abundance is imagining myself as a big, cranky dragon sat on her little pile of pennies. Do I need another pink faux fur coat? Um – what would a dragon do with a fur coat? Dragon Mode.

How I dragon

1. I check my finances every day

You’re not supposed to check your investments every day (whatever) but I check EVERYTHING every day. For one thing, I’m paranoid. For another, I’m obsessive. And finally, it’s my job.

I’m the breadwinner – our financial future is down to me. So, if I’m checking my little apps multiple times a day, it could be worse. Could be heroin.

Immersing myself constantly in my finances is the best way I’ve found, as a neurodivergent person, to be good at it.

2. I diversify for fun

I have serious investments, then I have fun investments. I have a spot of crypto, a micro-speck of gold, some private company shares. It’s socially acceptable gambling.

Until recently, I was a bit overexposed to the US stock market. I don’t know if you’ve heard, but things are a bit mad over there. I’ve been reading about what happens if the AI bubble bursts and, pals, it ain’t pretty. I took a chunk out of US stocks to hold in cash, either within my stocks and shares ISA for the higher interest rate or in premium bonds. Retro vibes.

I also put more into Gilts, because I found the low and slow growth appealing, and I wanted more UK investments. I really understand very little about Gilts but they’re safer than a stock market heading for the stratosphere with no frickin’ parachute.

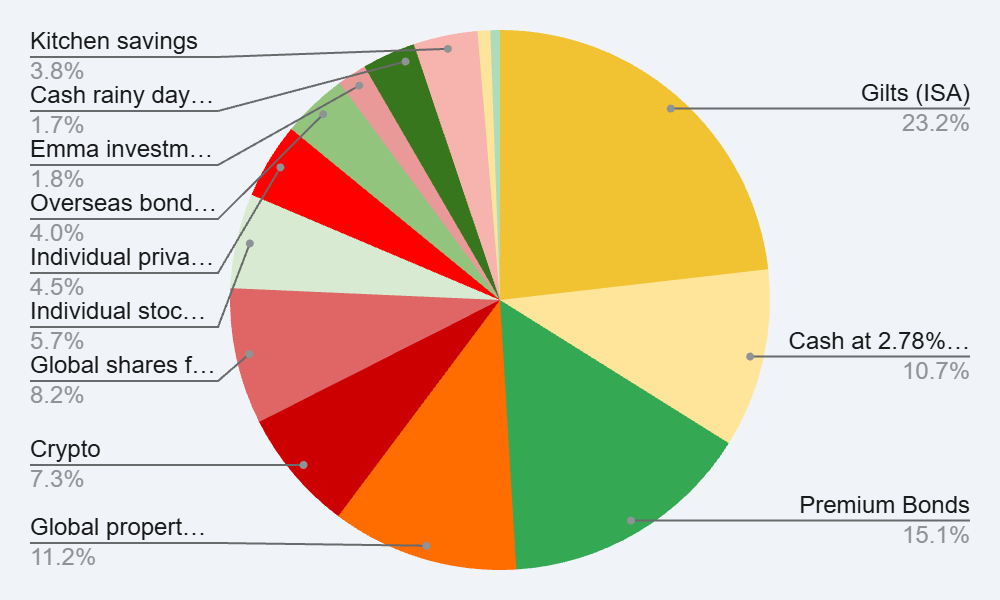

After I’d done my rebalancing, I used Gemini in Google Sheets to build myself a spreadsheet showing my portfolio, so I won’t get so unbalanced in future. I also keep a running tally of my asset wealth (excluding the untouchables: house equity, pension and pitiful emergency fund).

This looks impressive but please bear in mind that we could be talking double digits for some of these ‘wealth assets’. Fake it ’til you make it, eh?

3. I do bonkers stuff

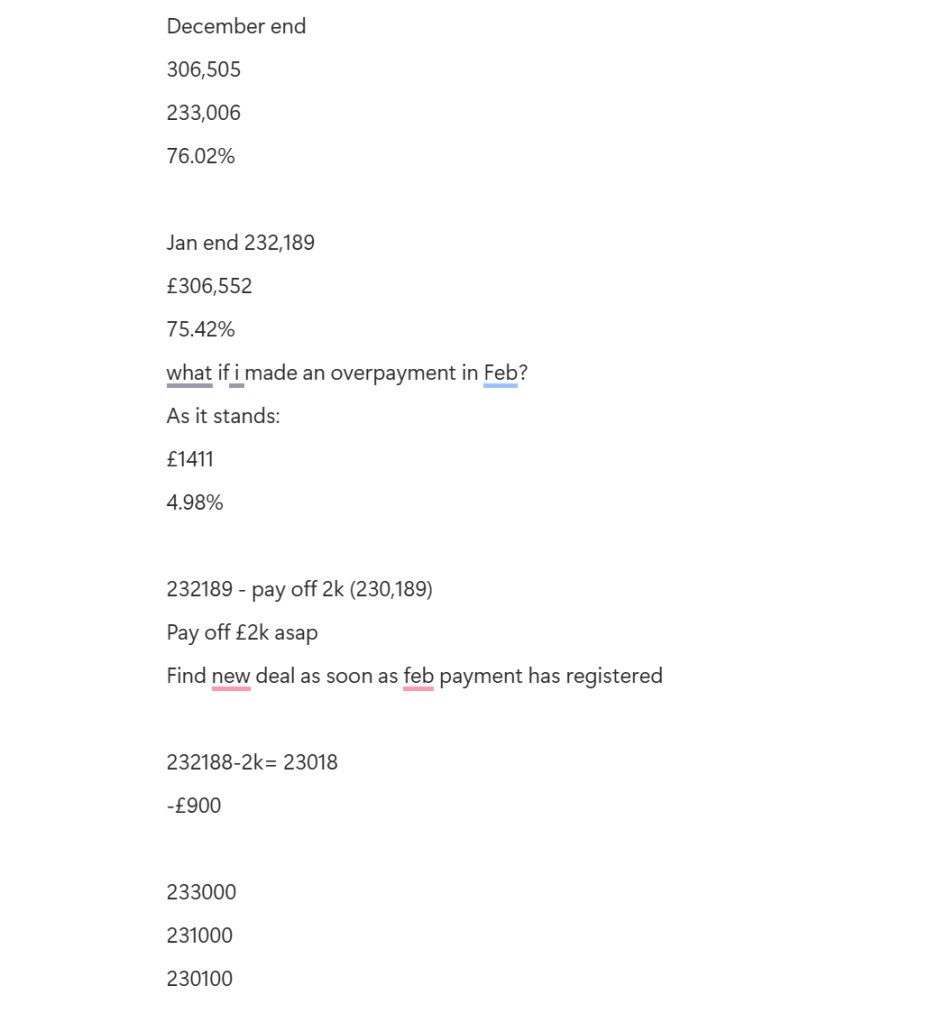

I have a logbook of when I was remortgaging two years ago. It details my DAILY fight to get our interest rate down to 4.64%, after our starting rate of 1.37% ended.

I used Habito’s free mortgage broker service to access information I might not be able to get hold of. For example, they knew before Nationwide’s customer service agents that a rate increase was going in. They were also able to cancel products for me as new rates became available – Nationwide requires you to TALK TO A PERSON. No thanks.

I did also use Nationwide’s own tool when Habito weren’t fast enough for me, so that I was able to shave off percentage points at a time (I think I got through six different deals) leading up to the switch. I was DETERMINED that our mortgage would not cost more than our rent did before we bought a house.

In the months before the new rate began, I made a lump overpayment I could barely afford and I started overpaying monthly. This helped lower the LTV for better rates but also softened the blow when the increase hit.

Let me tell you: I still felt that increase. It’s been challenging to manage alongside every single thing in life getting more expensive and my stagnant salary losing value as inflation stays high. I’m at remortgage again now and I have been counting down the days to a lower monthly payment.

However: I’m proud that I was able to absorb an increase in monthly household costs that could have knocked us down. Not easy, but I got it done.

4. I visualise myself as an actual dragon

It helps. I’m naturally an acquirer of interesting things but unfortunately shoes and vintage clothes are not appreciating assets. They really just fill up my house and bring me unparalleled joy. And everyone knows that joy has no place in capitalism.

When I see myself as this dragon on her wee pile of coins, I can stop myself buying stupid stuff. I’ve genuinely been considering a dragon tattoo.

Dragon Mode, activated.

Am I right? Tell me!